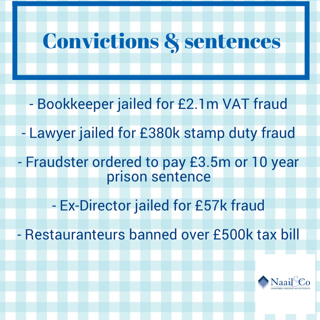

Fraud convictions & sentences: July 2021

Table of Contents

Bookkeeper jailed for £2.1m VAT fraud

- Croydon based booker arrested at Heathrow Airport for £2.1m claim of fraudulent VAT repayments

- Fraudster received a £1.6m pay out from fraudulent transactions. He spent £411,000 on luxurious cars, £149,000 on flights, £112,000 on foreign exchange and £131,000 to pay off wife’s parent’s mortgage

- He was found guilty on all three counts at Southwark Crown Court on 2 July 2021 after a month-long trial.

- Confiscation proceedings are currently underway to recover the stolen money.

Lawyer jailed after £380k stamp duty fraud

- Former owner of a West London law firm sentenced to three years and 4 months in prison for stealing £380,000 in fraudulent stamp duty tax returns on client property sales

- 52 fraudulent stamp duty land tax returns to HMRC between November 2010 and July 2015

- Fraudster has repaid around £253,000 of the stolen stamp duty land tax and proceedings are still ongoing to recover the remaining amount.

- Disqualified from being a company director for six years, company liquidated and struck off by the Solicitors Regulation Authority.

- He admitted to cheating the Public Revenue at Isleworth Crown Court on 6 July 2021

Fraudster ordered to pay £3.5m or 10 years prison sentence

- Fraudster focused on the false claiming of VAT repayments by using forged documents

- In May 2021, an extensive investigation of John Dalton’s assets was held at Inner London Crown Court and on 28 June 2021, Judge Silas Reid handed down his written ruling which ordered Dalton to pay a confiscation order of £3,491,433

- If he fails to pay the full amount within three months, he faces a further 10-year prison sentence.

- He was eventually located in Spain, where in 2017 he was detained and extradited to the UK

Ex-director of disability charity jailed for £57k fraud

- A man who set up a charity has been jailed for fraud after stealing £57,000 from charity pot

- He created a Foundation in the name of his brother who had cerebral palsy to help disabled and seriously ill children and adults by funding therapy, medical treatment and specialist equipment

- He transferred £57,000 from the foundation to his own bank account. Some of the money was used for his wedding photographer

- His Foundation was removed from the Charity Commission register

Restaurateurs banned over £500k tax bill

- Three restaurateur brothers have been banned after under-reporting their restaurant’s earnings, building up a tax bill of over £500,000 in VAT & corporation tax

- The Insolvency Service established they systematically under-reported their earnings, by deliberately destroying and removing sales records in their company accounts which totalled a £566,749 tax bill to HMRC when the brothers placed the company into Creditor Voluntary Liquidation in August 2018.

- Companies have limited liability, which is a privilege, not a right, and The Insolvency Service have strong enforcement powers which we will not hesitate to use to remove that privilege from dishonest or reckless directors

Our service to you

If you are a self employed, business owner/director of company looking to get your accountancy and taxation matters sorted, look no further. We, at Naail & Co, are pro-active and easily accessible accountants and tax advisors, who will not only ensure that all your filing obligations are up to date with Companies House and HMRC, but also you do not pay a penny more in taxes than you have to. We work on a fixed fee basis and provide same day response to all your phone and email enquiries. We will also allocate a designated accounts manager who would have better understanding of your and business financial and taxation affairs. Book a free consultation call using the link below.

Related pages:

Get further information from the following pages;

Subscribe to our newsletter

BUSINESS HOURS

Monday – Friday

- 9:00 am – 5:30 pm

Pages:

Menu